BOOTCAMP Deep Quant Finance

No content

Derivatives Valuations & Risk Portfolio Management (DQF) [175 HOURS]

| Sn | Topics |

| Finance basics with Python | |

| 01 |

Setting up Python Infrastructure

|

| 02 |

Arithmetic operations

|

| 03 |

Data Structure

|

| 04 |

Object Oriented Programming

PythonLab – Create a Custom Class for Black Scholes Option Price and Greeks |

| 05 |

Numerical computing with NumPy

|

| 06 |

Data Analysis with Pandas

|

| 07 |

Data Visualization with Matplotlib, Seaborn & Cufflinks

|

| 08 |

Calculus

Python Lab – Solving the heat equation |

| 09 |

Numerical Integration

Python Lab – Custom class to find CDF of normal distribution using numerical integration |

| 10 |

Probability & Statistics with SciPy

Python Lab – Custom Class for numerical computation of Expectation and Variance |

| 11 |

Univariate Financial Time Series Analysis with Statsmodels

Excel & Python Lab – Custom class to perform Box-Jenkins methodology to fit the best model. |

| 12 |

Multivariate Financial Time Series Analysis with Statsmodels

Excel & Python Lab – Joint forecasting of macro-economic time series |

| 13 |

Conditional Volatility Models

Excel & Python Lab – Custom Class for Value-at-Risk under different volatility models |

| 14 |

Monte Carlo Methods

|

| 15 |

Copula Models

Excel & Python Lab – Simulating default times for a nth to default basket CDS. . |

| Stochastic Calculus for Finance | |

| 01 |

Stochastic process

|

| 02 |

Change of Measure

Excel & Python Lab – ABM, GBM, OU |

| Equity Derivatives | |

| 01 |

Binomial Asset Pricing Model

|

| 02 |

Black Scholes

|

| 03 |

Jump Process

|

| 04 |

Finite Difference Methods for Option pricing

Excel & Python Lab – Price first generation exotics using Finite Difference |

| 05 |

Monte Carlo methods for Option pricing

Excel & Python Lab – Custom class for Exotic pricing and Greeks |

| 06 |

Volatility Surface

Excel & Python Lab – Custom class for pricing under Heston and SABR models |

| Interest Rate & FX Derivatives | |

| 01 |

Rates and Rate Instruments

Excel & Python Lab – valuation of Bonds, FRAs and Swaps |

| 02 |

Term Structure Models

|

| 02 |

Options on rates

Excel & Python Lab – Calibration of swaption volatility surface |

| 03 |

FX Instruments

Excel & Python Lab – Pricing of FX derivatives with volatility smile Excel & Python Lab – CVA calculation for a portfolio of derivatives |

| Quantitative Portfolio Management | |

| 01 |

Portfolio Theory & Optimization

Excel & PythonLab – A real life portfolio optimization problem Excel & Python Lab – Implementation of Pairs-trading (A statistical arbitrage trading strategy) |

| Machine Learning for Finance | |

| 01 |

Traditional Supervised algorithms using Scikit Learn

|

| 02 |

Traditional Unsupervised algorithms using Scikit Learn

|

| 03 |

Deep Learning with Tensorflow

|

ABOUT THE TRAINER

No content

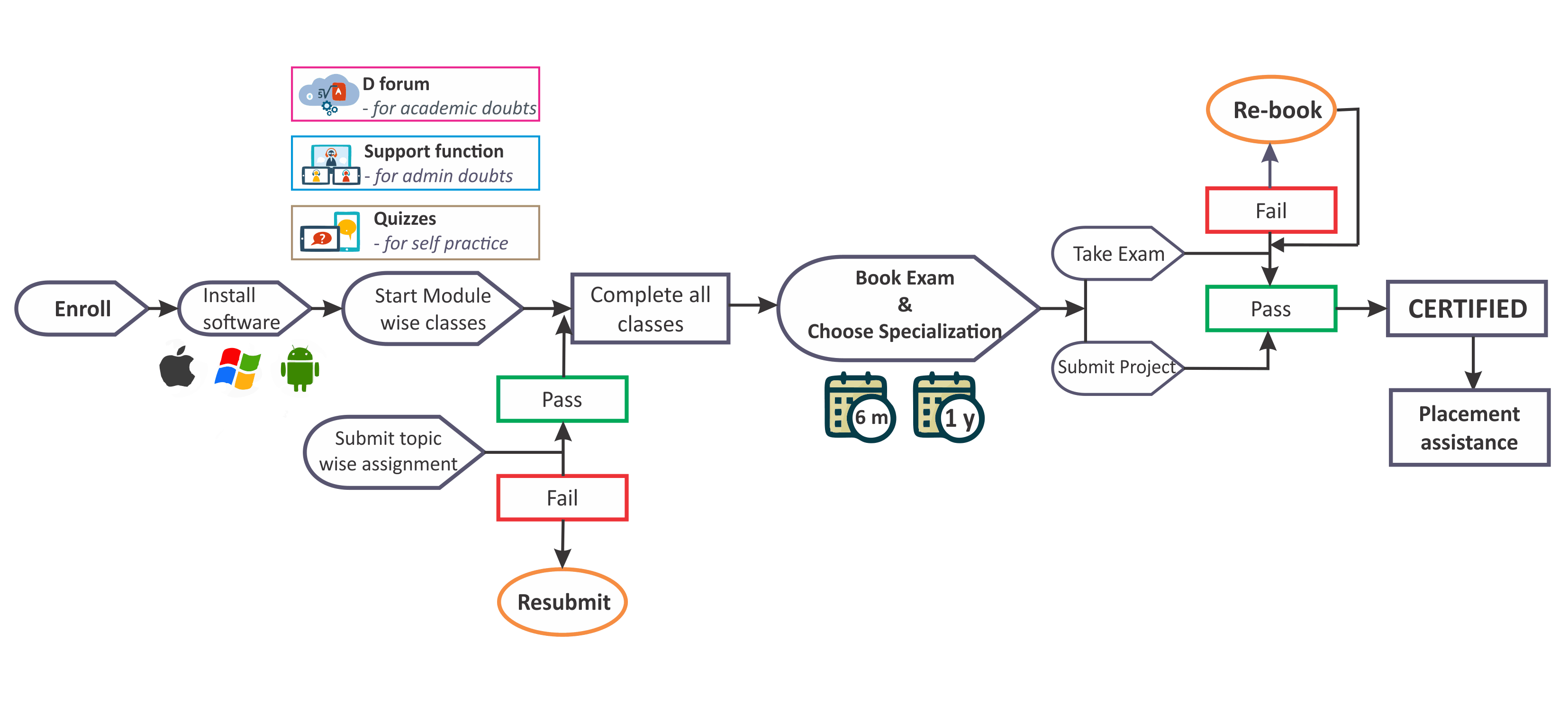

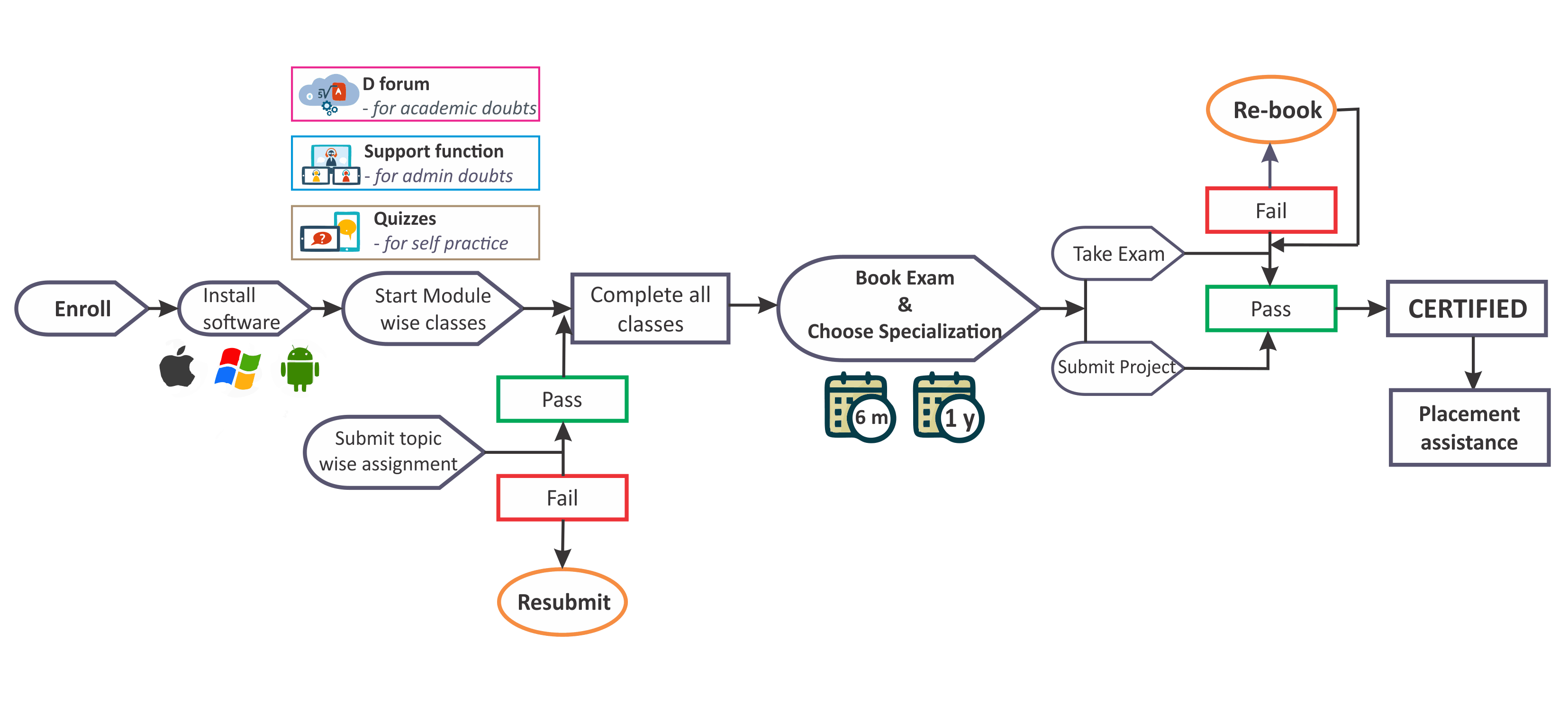

Ans 1. Anyone with finance/CA/CFA/FRM/Engineering Background can join this program. Basic knowledge of statistics is recommended but not compulsory

Ans 2. Market risk and counterparty capital charge program focuses on regulatory specific modelling and doesn't require advanced level of math's. Also the entire program is taught in Excel & Python to facilitate easy understanding of all models.

Ans 3. It is a 100% practical program with dozens of case studies, spreadsheet models & python codes. The approach of delivering the concepts is application based to make you a right fit for market risk consulting.

Ans 4. To get certificates you need to complete all topic wise assignments, final project and pass the MCQ based exam.

Ans 5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans 6. With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone. We don't allow connecting multiple monitors to laptop. We allow classes on 3 devices - laptop, Mobile and Tablet with no simultaneous login

Ans 7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans 8. You can schedule your exams anytime after course completion but before the expiration of validity.

Ans 9. Every class is supported by one note files, excel sheet, python files and reading material. All these are available in the course section only.

Ans 10. Letter of Recommendation is virtually delivered within 60 days of passing the exam. LOR’s also mention the details of the final project completed to avail the certificate.

No content

Derivatives Valuations & Risk Portfolio Management (DQF) [175 HOURS]

| Sn | Topics |

| Finance basics with Python | |

| 01 |

Setting up Python Infrastructure

|

| 02 |

Arithmetic operations

|

| 03 |

Data Structure

|

| 04 |

Object Oriented Programming

PythonLab – Create a Custom Class for Black Scholes Option Price and Greeks |

| 05 |

Numerical computing with NumPy

|

| 06 |

Data Analysis with Pandas

|

| 07 |

Data Visualization with Matplotlib, Seaborn & Cufflinks

|

| 08 |

Calculus

Python Lab – Solving the heat equation |

| 09 |

Numerical Integration

Python Lab – Custom class to find CDF of normal distribution using numerical integration |

| 10 |

Probability & Statistics with SciPy

Python Lab – Custom Class for numerical computation of Expectation and Variance |

| 11 |

Univariate Financial Time Series Analysis with Statsmodels

Excel & Python Lab – Custom class to perform Box-Jenkins methodology to fit the best model. |

| 12 |

Multivariate Financial Time Series Analysis with Statsmodels

Excel & Python Lab – Joint forecasting of macro-economic time series |

| 13 |

Conditional Volatility Models

Excel & Python Lab – Custom Class for Value-at-Risk under different volatility models |

| 14 |

Monte Carlo Methods

|

| 15 |

Copula Models

Excel & Python Lab – Simulating default times for a nth to default basket CDS. . |

| Stochastic Calculus for Finance | |

| 01 |

Stochastic process

|

| 02 |

Change of Measure

Excel & Python Lab – ABM, GBM, OU |

| Equity Derivatives | |

| 01 |

Binomial Asset Pricing Model

|

| 02 |

Black Scholes

|

| 03 |

Jump Process

|

| 04 |

Finite Difference Methods for Option pricing

Excel & Python Lab – Price first generation exotics using Finite Difference |

| 05 |

Monte Carlo methods for Option pricing

Excel & Python Lab – Custom class for Exotic pricing and Greeks |

| 06 |

Volatility Surface

Excel & Python Lab – Custom class for pricing under Heston and SABR models |

| Interest Rate & FX Derivatives | |

| 01 |

Rates and Rate Instruments

Excel & Python Lab – valuation of Bonds, FRAs and Swaps |

| 02 |

Term Structure Models

|

| 02 |

Options on rates

Excel & Python Lab – Calibration of swaption volatility surface |

| 03 |

FX Instruments

Excel & Python Lab – Pricing of FX derivatives with volatility smile Excel & Python Lab – CVA calculation for a portfolio of derivatives |

| Quantitative Portfolio Management | |

| 01 |

Portfolio Theory & Optimization

Excel & PythonLab – A real life portfolio optimization problem Excel & Python Lab – Implementation of Pairs-trading (A statistical arbitrage trading strategy) |

| Machine Learning for Finance | |

| 01 |

Traditional Supervised algorithms using Scikit Learn

|

| 02 |

Traditional Unsupervised algorithms using Scikit Learn

|

| 03 |

Deep Learning with Tensorflow

|

No content

Ans 1. Anyone with finance/CA/CFA/FRM/Engineering Background can join this program. Basic knowledge of statistics is recommended but not compulsory

Ans 2. Market risk and counterparty capital charge program focuses on regulatory specific modelling and doesn't require advanced level of math's. Also the entire program is taught in Excel & Python to facilitate easy understanding of all models.

Ans 3. It is a 100% practical program with dozens of case studies, spreadsheet models & python codes. The approach of delivering the concepts is application based to make you a right fit for market risk consulting.

Ans 4. To get certificates you need to complete all topic wise assignments, final project and pass the MCQ based exam.

Ans 5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans 6. With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone. We don't allow connecting multiple monitors to laptop. We allow classes on 3 devices - laptop, Mobile and Tablet with no simultaneous login

Ans 7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans 8. You can schedule your exams anytime after course completion but before the expiration of validity.

Ans 9. Every class is supported by one note files, excel sheet, python files and reading material. All these are available in the course section only.

Ans 10. Letter of Recommendation is virtually delivered within 60 days of passing the exam. LOR’s also mention the details of the final project completed to avail the certificate.